GOOG trading strategy and notes

This will be an evolution of my trades of GOOG, the stock symbol for Google. Ideally the decisions made will be good ones, but because nobody ever really knows what direction a stock can make on a day to day basis, this will be a fun ongoing exercise in the evolution of my trading strategy around GOOG. I will make some mistakes along the way, but if you’re interested, I invite you to follow along and share some strategies on how to grind out gains over time.

Getting Started

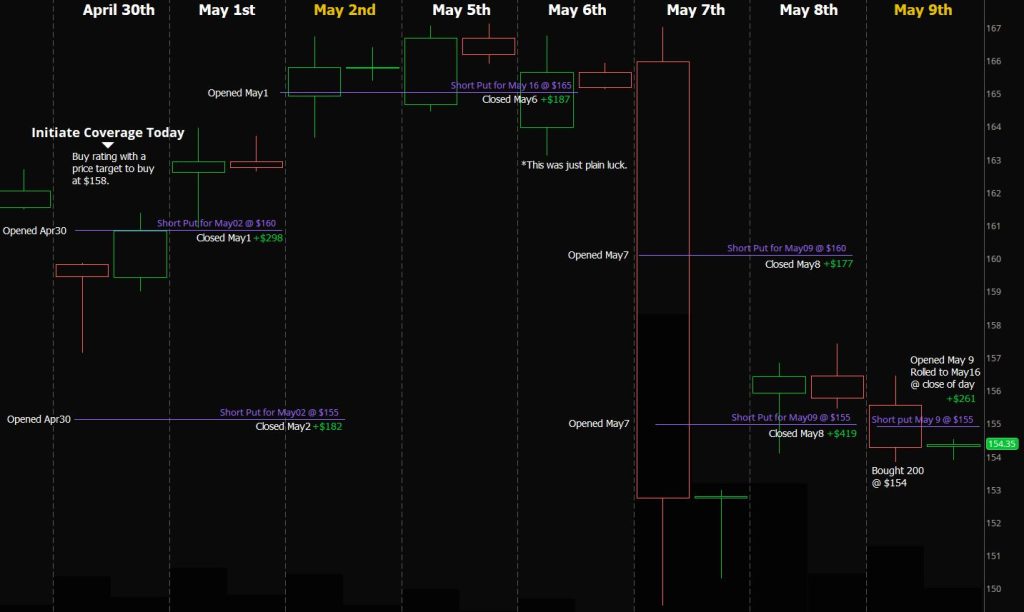

Being completely honest, I started my coverage on Google with a “buy” rating on April 30th when it was at $158. My attitude then was that it was a good time to buy in, and begin with a strategy. On this date, I began to make a couple of moves. Selling a “short put” is a way to go “long” on a stock. If the stock goes up after taking a position like this, there is a gain likely. So what I did was sell two different PUT contracts. One was at $160, which gave me $2.99 in credit, which means if I let the contract assign, then I’d end up buying shares at $157.01 per share. The other contract was a short put at $155, it gave me a credit of $2.11, so if the price was below $155 on May 2nd, then the shares would only cost me $152.89.

In the outworking of everything though, neither of these contracts was going to happen, the price stayed above $160, and so both contracts were eventually going to expire worthless. I paid tiny amounts to close them because I like things neat and tidy (sometimes) and had to move on.

Here are detailed descriptions of each move, it’s intentions, and it’s result.

Short Put May 2 $155 credit $210

Intention: If the price were to be below $155 at the end of the day May 2, then I would effectively be buying the shares at $152.89. This is well below my initial assessment of what I felt GOOG is worth, so I was willing to take on this contract.

Result: +$182 The price stayed way above $155 on May 2, so this contract was pure credit. I did pay $28.66 to close it early in the day.

Short Put May 2 $160 credit $298

Intention: Should the price be below $160 at the May 2 close, then I would effectively be buying the shares at $157.01.

Result: +$298 The price stayed above $160 on May 2. Part way through the day, I rolled this position to a short put for May 16th at $165 for a credit.

Short Put May 16 $165 credit $497

Intention: I was still trying to get assigned some GOOG stock, but I raised the price a bit. If I let this one go, the net cost of the assigned shares would have been just above $160.

Result: This particular contract ended with a stroke of luck. On May 6th, I wanted to free up some of my overall account responsibility, and was looking around for positions I could “clean up” just to shore up the overall margin obligations. I took a look at this position, and thought “Do I really want to buy this at $165 if this executes?” Looking at the current Profit & Loss of the position, it was sitting at +$187 so I thought maybe I would be best to just close this for now, and wait for a dip. I had to pay a total of $310 to close this contract, but that still left me with a net credit of +$187

On May 7th Apple shocked the market for Google when they revealed that their actual searches where Google is utilized are much less than previously thought as people move to use AI for searches instead of typical browser searches.

At this point I was of course ecstatic with the price plunge because maybe now I can get in at the price target I wanted to, or maybe even better!

Short Put May 9 $160 credit $1,058 executed 3/4 of the way to the bottom of that big red bar on May 7th.

Intention: At this point I am taking advantage of the market literally selling off Google like it’s being liquidated everywhere. I am not actually looking for a close above $160 in this case, I am simply trying to play the bounce for some credit.

Result: +$177 The price did bounce back on May 8th, and I decided to just take the win, and wait for Friday to see what happens on this one. I paid $881 to close the contract, but it was a win nonetheless.

Short Put May 9 $155 credit $658 executed near the bottom for the day on May 7th

Intention: This one I actually was aiming at perhaps taking assignment. If I had let this one run, the net cost of the shares would have been just below $152.

Result: +$419 The price bounced back so well on May 8th, and staring at a 50% gain in less than one day, a trader has to take it. I paid $239 to close but it was worth it.

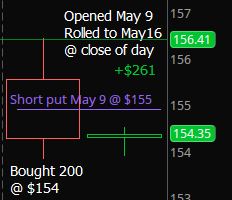

Short Put May 9 $155 (AGAIN) credit $260

Intention: Today I was actually standing in line at the tax office here in PV, having to renew some info that I could only do in person. Since there was another deep dive in the morning right off the opening bell, I thought to myself “today is the day I will actually buy some GOOG. One way or another, I will put some shares in the account today and just keep flirting with short put options.

Result: +$260 Today the price went below $154, just for a few minutes, but I decided that I would just simply buy the shares right then for that price, and then turn my short put contract into a “strangle” for next week. I paid $154 per share, and bought 200. Now, the dynamic of how I will trade GOOG will be adjusted into a slinky and strangle. More on that in the next post.

There is the May 9th moment where I decided to actually “BUY” some stock. I bought at $154, which is below my initial target of $158 so I am content with that entry point.

Now I am going to keep grinding this thing out until I get it to where it’s a 30% gainer. I think this is possible in less than a years time, but that of course depends on a lot of factors and macro events that could change things completely for GOOG, and for me.

| Tracking the Results | |

|---|---|

| Goal 1 Year | +30% |

| Amount Invested | $30,800 |

| Realized Gains | $1,524 +4.9% |

| Overall Position | $1,317 +4.2% |

| Time span: 10 days April 30 to May 9 | |